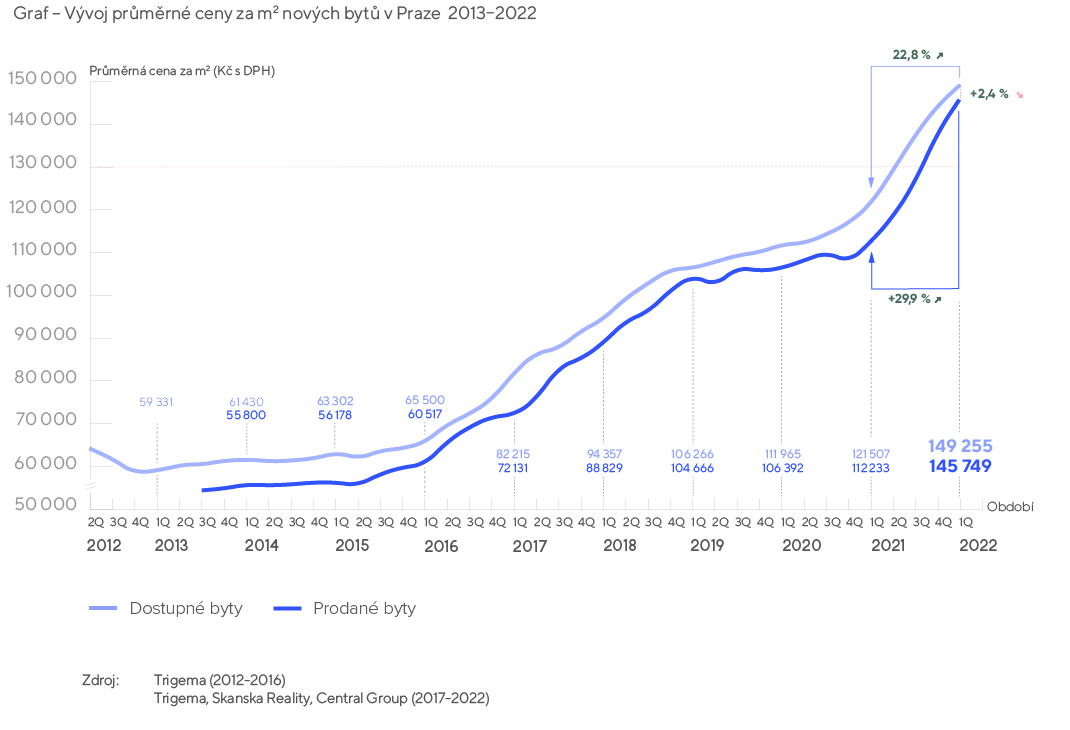

The price of new apartments in the capital city continues to rise. The average sales price in Prague reached 145,749 CZK/m2. in the first quarter this year. This is almost 30 percent higher than a year ago. This figure is based on a joint analysis by Trigema, Skanska and Central Group. The increasing prices are mainly due to the supply, which has remained at only around 3 thousand new apartments for almost a year, alongside steep rises in input prices, in particular the cost of construction labour, materials and energy.

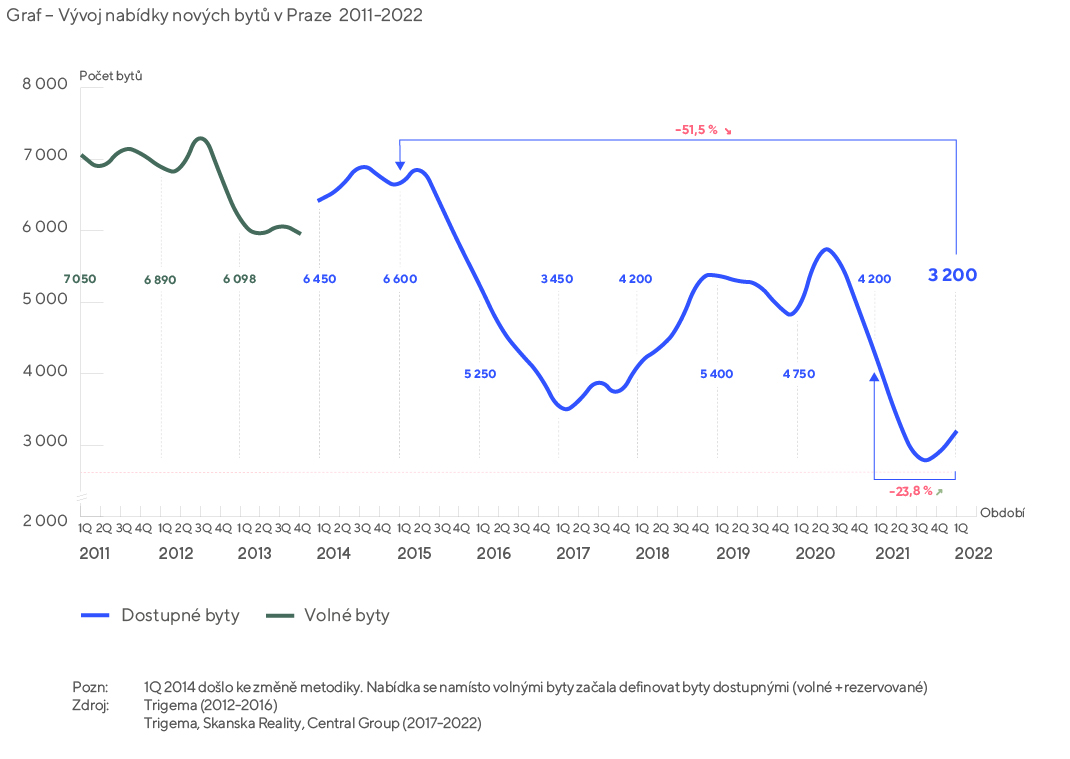

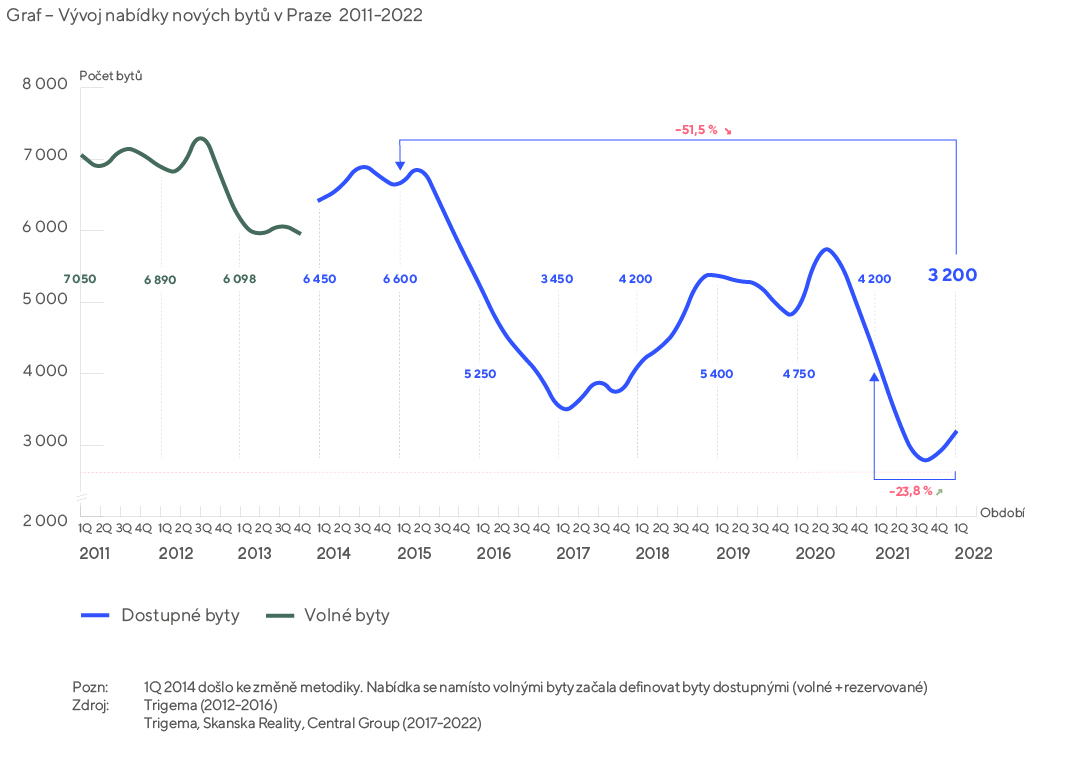

In the first three months of this year, 1,050 new apartments were sold, and at the end of the first quarter those seeking a new home were only able to choose from around 3,200 new apartments. Compared to the same period last year, they had 1,000 apartments (24 %) fewer to choose from. Due to complex approval processes, the supply of new apartments has failed to reach adequate numbers for many years. The number of new available apartments in the capital city has remained at around 3 thousand for a year now, yet in the past twice this figure was common.

“In the first quarter of the year, homes sold were only weakly replenished, with numbers needing to be at least three times as high in order to satisfy long-term market demand. Czechs continue to want to buy new homes: we know from our survey that real estate is still considered the safest and most profitable type of investment even in this uncertain time. Working against demand being satisfied, however, is the lengthy approvals process for new buildings, which has still not been streamlined. The oft-mentioned rental homes market does not resolve this issue, only partially covering the supply,” says Petr Michálek, General Director of Skanska Reality.

The lack of new apartments is one of the main reasons for this further increase in prices. Also playing a significant role alongside this, however, is the further significant increase in input costs. The war in Ukraine has resulted in disrupted supplier-customer relations, having a negative impact on the accessibility and price of building materials. Some building components have increased in price by dozens of percent since the start of the year, with some crucial materials increasing by a few hundred percent. Rebar, cement, insulating materials, metal sheeting and many other input materials, for example, have seen significant price rises. Energy has also increased significantly in price, as have loans as a result of measures taken by the Czech National Bank.

The sales price for new apartments rose to 145,749 CZK per m2 (a 29 % increase year-on-year), coming very close to the bid price, which at the end of the quarter ranged just below the level of 150 thousand CZK/m2 (149 255 CZK/m2, a 22.8 % year-on-year increase). Until now, bid prices have consistently remained at a level of around 5-10 % above sales prices.

“Unfortunately, increasing apartment prices copy the current situation, with the fewest new apartments available on the market for the last ten years. The supply was almost completely sold last year, and lengthy approval processes continue to hold new construction back. At the same time, escalating prices for all inputs are reflected in the increasing prices for apartments: commodities, energy, interest rates and human resources,” says Marcel Soural, Chairman of the Board at Trigema Investment Group.

The low level of supply, the uncertainty regarding future developments and price rises and poorer access to mortgages with Czech National Bank directives leading to the reintroduction of DTI and DSTI mortgage limits so that you can borrow at most 80 % of the value of a property (except for applicants up to 36 years of age) have resulted in some people seeking a new home postponing their decision to make a purchase.

In the first quarter, a total of 1,050 new apartments were sold, the fewest number since the second quarter of 2020, when 1,100 were sold. It might seem from this slight cooling off in demand that supply might increase. This increase, however, will only be minimal, and nothing fundamental will change in reality. The supply is still far from being able to cover demand.

“Recently there has been a reduction in clients taking out mortgages, which are now more expensive. But on the other hand, there is also a large increase in numbers of people investing their savings by buying an apartment because they are worried about depreciation. A new apartment is a safe investment and one which protects against inflation,” says founder and head of Central Group, Dušan Kunovský, of this trend of recent weeks.